to get insurance quotes in your area

How Does Your Credit Score Affect Auto Insurance Rates?

Not every state allows car insurance rates to be affected by credit scores. For the states that do, it is a smart plan to be aware of how your rates can be affected.

What Is The Effect Of Credit Score On Rates?

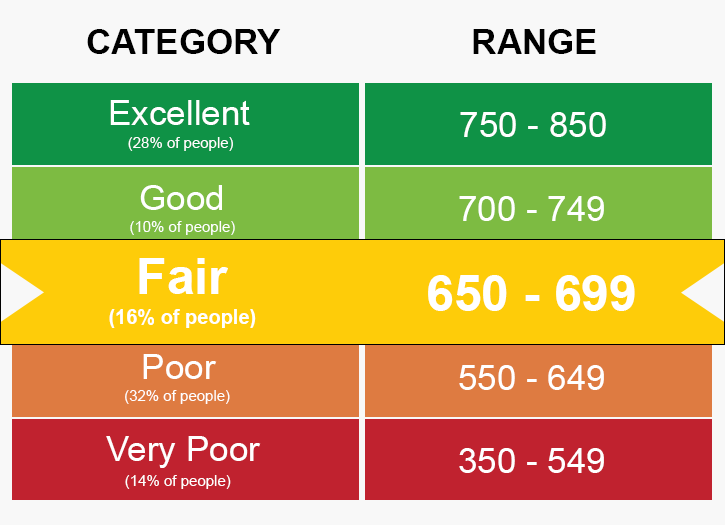

A credit score is a number, three digits, that is widely used as a marker of financial fitness. The higher a person’s credit score is, the more likely they are to repay their debts. Your credit score is determined using your past credit history, among other variables. Companies can use this information to decide if you are a low-risk or high-risk client.

Car insurance is not a loan, however, so why would a credit score affect car insurance rates? While the answer may not seem simple at first, upon closer look, it makes a lot of sense.

People with a lower credit score are often deemed to be a higher risk to car insurance companies. The reasoning for this is that there is a statistical correlation between having a low credit score and the likelihood of filing a claim. This means rates can go up or down as your credit score does.

How Does A Credit Score Affect Rates Exactly?

Auto insurance company’s statistics to determine risks and prices. The rates you pay for car insurance premiums will go up as your credit score goes down. In fact, rates can increase up to $200 or more for people on the lower end of the credit rankings. It is also important to note that car insurance companies don’t always use FICO scores, they sometimes have their own scores they use.

Studies have shown that people in the lowest ten percent of credit scores cost insurance companies an average of around 200 dollars more in losses for the car insurance companies than those that are not in that lowest ten percent. On the highest end of credit scores, the people cost an average of around $120 less per person. This segment of people tends to pay less for insurance because of it.

It has also been said that Americans are less aware of their credit scores than they should be. This is true. Each person should be mindful of their credit score, and for each person one free credit report per year is given to help people pay attention to it.

Did you know:

- 69 percent of people incorrectly assess their credit scores.

- 73 percent of Americans think their credit score is good, but only 41 percent actually have good credit.

- While 41% of people have good credit, 42% have poor credit.

Most people do not place themselves accurately to where their score is, with states that have lower average credit scores typically being the worst at assessing their scores.

Nationally, insurance rates are almost double for people with poor credit, versus those that have excellent credit. That said, even an improvement from poor credit to good credit can have a drastic effect on your car insurance rates. Some studies have shown that the savings can be up to 32%. Moving from a good credit score to an excellent one can save people up to an additional 27% or more. The benefits of improving your credit score extend far beyond just car insurance too, helping get you lower interest rates on loans and lower interest rates on credit cards.

What Can You Do If Your Credit Score Changes?

The good thing is that low credit scores are a variable that you can work to change. Improving your credit rating may take time, but it can save you money on your insurance rates in addition to the many other benefits it can provide in life. If your credit score does change, you need to take steps to take advantage of the savings that you can get.

Follow these steps to get better rates on car insurance as your credit score improves:

Let your car insurance company know and have them plug in the new numbers.

Continue to monitor your credit score in case of additional improvements, issues, or mistakes.

Checking to see if your state allows automobile insurance companies to utilize your credit score when determining rates is an excellent first step. Three of the states that do not allow credit scores to affect your automobile insurance premiums are Hawaii, California, and Massachusetts. Some people believe that car insurance companies utilizing the statistics for credit scores is unfair, and in the future, more states may prevent companies from using credit scores to help determine rates.

Either way, there are some tips you can follow to help get the best rates. Tracking and taking the time to understand your credit reports is the biggest first step. Utilize your free yearly credit report to get updated information. You can choose to obtain additional credit reports by paying for them, but either way, take advantage of the free one you get each year.

Additionally, pay your bills on time, and do not skip payments. These can have adverse effects on your credit score, which can lead to higher car insurance rates. Paying what you owe, and not having large amounts of debt is another way to raise your credit score. There are also a large number of credit scores that have errors in them. Keeping your credit score accurate is an important way to help get the best rates. By removing mistakes, your credit rating may go up.

Keeping your credit reports clean and working on improving them has vast benefits, and your credit rating likely affects your car insurance premiums, so be sure to follow through on checking it regularly.

Utilizing your improving credit score is a fantastic way to save money, and your General Insurance agent or contact will help answer any further questions you have. Get the best rates from General Insurance today!

Add new comment